Announcement

SEMI FINAL | BUSINESS CASE - BCS 05

Finance Manager Submission BCS 05

NMO 2020

Annual Operating Plan Of Velo Motors Pvt. Ltd.

Submission Date & Time : 2020-04-11 04:30:10

Submitted By: Naseef nazar Nalakath - Finance Manager From Team Sky

Assignment Taken

Prepare an annual operating plan for Financial year 2020-21Case Understanding

ABOUT THE COMPANY: The company is a start-up, with 40 lakh of corpus capital pooled by the owners. The company looks to foray into electric vehicle business where penetration is very low in India. The company believes that Electric Vehicle will soon expand in Automobile industry and the company will be the dominant player in this new market. The company also looks to reap the benefits provided by the government and aims for Long term sustainability. PROBLEMS RELATED TO OPERATION & FINANCE 1) Small corpus fund (40 Lakh) in an industry with huge Cost of manufacturing and R&D 2)As a new player, it will be difficult to reach break-even in the near future. 3) The market has competition from Large players like TVS, and other small players too. 4) Since it is a developing industry, uncertainties in cost, externalities and market fluctuations are more prone in the industry as a whole.BCS Solution Summary

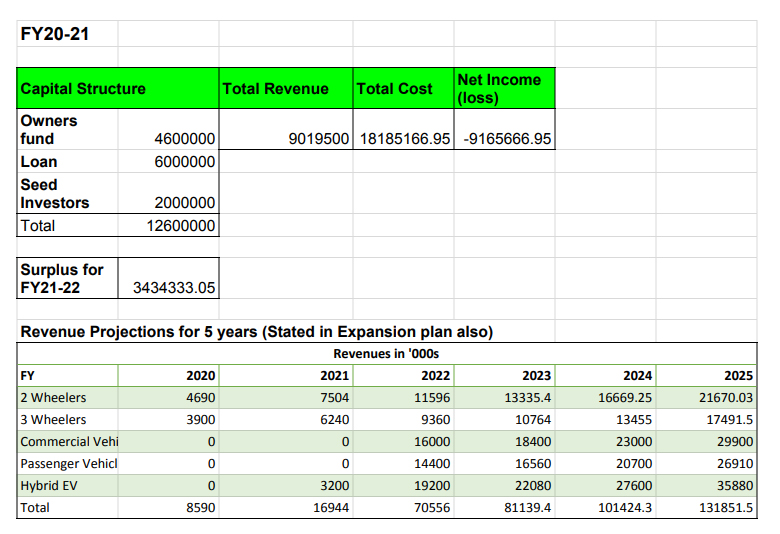

Velo motors will launch its 4 electric vehicle models (2 in 2-wheelers and 2 in 3-wheelers) in FY20-21. Although there are capital and prototype restriction, we will aim for market entry to gain upper hand over new entrants expected in the near future. By launching this year, we aim to reach economies of scale and economies of scope by 2025. The detailed capital structure, income and cost for FY 20-21 is given in the solution below.Solution

Overview of Financial plan for FY20-21

Capital Structure

-

46L- owner’s fund

- 60L- Loan

- 20L- Seed investors

Total Capital- 1.26 Crore

Revenue and Cost

-

Total Revenue- 90L

- Total Cost- 1.81 Crore

- Net loss- 91Lakh

Operational Plan

Operational objectives and plan for the FY20-21

- In the first year, our company will rely on contract manufacturing. Note that the factory and its machinery will be setup for the Third financial year (after second round of fundraising).

- The company looks to launch its business in Bangalore itself (since all the employees are based on Bangalore for now) for the first year and looks to cater to middle-class citizens. It will also expand to Mumbai, Pune, & Delhi in the next years as these cities have well-developed EV infrastructure like charging centres, etc. It is difficult to sell EVs in rural markets as electricity and voltage issues are a concern.

- To overcome the issue of less capital, we look towards seed investors through fundraising campaign. A 20L is the projection from these investors.

- Even though there are capital and prototype development restrictions to the company, we will launch the product first year itself to gain an early advantage. The longer the entry is delayed, the more chances of stronger competition as government is increasingly pushing this field as well as there are huge growth opportunities.

Finance Requirement OR Cash-Flows for FY20-21

Sales

70 units of 2 wheelers (2 models-selling price 26K and 44K) and 30 units of 3 wheelers (2 models- selling price 52k and 84k), i.e. 200 unit is the sales target for the first year. This will generate 90L of revenue. Note that there is a 5% GST on electric vehicles charged on the consumers. This was recently slashed down from 12%, in efforts of the government to boost EV industry. Also, the customer can get a rebate up to 1.5 Lakhs on interest paid if he takes a loan to purchase EV. All these can be utilised to boost sales.

Cost

Cost of manufacture

Cost of manufacturing (Contract manufacturing) will be roughly 74 Lakh for the production. The Union government had allotted ₹10,000 crores (budget 2019-20) to accelerate EV adoption in India under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India, or FAME 2, scheme. Due to this, there are manufacturing plants being set up by big companies such as Tata and others. Hence, we will stick to contract manufacturing but will move to factory production soon.

Note that most of the critical electrical and electronic parts for vehicles made in India continue to be imported but the costs will decrease by 2030 due to domestic infrastructure and production.

Personal monthly Expenditure

Every employee requires 50k/month making a cost of 48L for 8 employees. Since the employees are living in Bangalore where the cost of living is high, it will be difficult to reduce this expense. A proposal for a lower monthly salary+bonuses and hikes based on performance can help if the financials get tight. However, we are not resorting to such means at the beginning of the year.

Marketing

The expense for marketing is capped at 10L. This include

- print media

- digital marketing tools

- Exhibition in Global Expos.

- Promotion in Retail showrooms

- Participation in design challenge competitions based on best Prototype

- Participation in Environmentally Friendly Vehicle Conference (EFV), Exhibition/Exposition on energy-efficient products: This will be part of the fundraising strategy

Overheads and Miscellaneous

We will keep a 10L aside for any overhead or other expense that might arise. The uncertainty and fluctuations of costs are higher- due to 2 reasons- The company being a startup and EV industry is relatively new. Hence a sufficient amount of 10L is kept aside for this purpose.

Human Resource

Apart from salary, the hiring, training, retention and other HR-related costs will have a 1L budget.

Research and Development

With a 60% rebate provided by the government on R&D Expense, 10L on R&D becomes 4L. Sufficient budget to R&D is necessary at this stage since the prototype requires various modifications and testing to convert to a working model.

Interest Expense

With the 60L loans, an interest expense of 9.6L is recurring expense for 5 years.

Depreciation

Although depreciation is minimal in the first year, we must account for it in the costs. A 10% depreciation is assumed for the first year. We can use Straight-line Depreciation Method or Diminishing Balance Method to calculate depreciation for the further years. Depreciation for first year= 90k

Legal Cost

There are various regulatory permissions required from Government and local authorities. There is vehicle tax, Regulatory checks for vehicles, Approval for setting factory, etc. A provision for these costs too.

Tax

In September 2019, FM Nirmala Sitharaman announced a 15% income tax for Electric Vehicle manufacturing companies. This makes the effective tax rate (including surcharge and cess fee) to be 17.01%. This move will boost EV industry by local production of various parts required. A 15L (approx.) tax on 90L sales is levied on our company.

Operational objectives and plan after first year

With more funding from Investors, a factory will be established in the 3rd year (estimated cost- 5 crores for small manufacturing and assembling Unit). We aim for a 5 crore Venture capital investment in FY21-22.

Apart from 2-wheeler and 3-wheeler, we will launch into passenger vehicles and commercial vehicles by 2025. There will be different products to cater to different classes. Also type of vehicles will range from battery EV to Hybrid EV. We hope to take advantage of economies of scope and economies of scale by then.

Conclusion

With a strategic operating plan and proper budgeting, Velo Motors aims to launch into the market for FY20-21. However, we acknowledge that there will be hindrance in prototype development and fund management. With our optimistic perspective, we believe we can overcome those as well as other external factors that might deter our positionAttached File Details

Comments

Dr Saroj Kumar Dutta

Naseef I appreciate your efforts, found your solution closer to reality, Good Job Done.

Rajni Khosala

Quite a comprehensive insight into all spheres of activity! Goodluck

Amit Shrivastava

You are trying to cover each point which might be required to address the project completely. Your assignment is straight to prepare an Annual Operating Plan. You have also been advised with the available resources and challenge area. My suggestions would be, you should not worry about any other root cause, business case of the project as a whole etc. You need to identify your target of production and check with your resources and make a realistic plan. This will comprise your expenses involved to produce the identified targets, quality parameters, packaging and distribution using the resource. You can organize kick-off meetings with other people and review the progress. You need to have MIS to see the deviation from planed and actual to bring the reports in front of the management. Be specific and straight to the subject will be really useful.

Participant

Naseef nazar Nalakath

IIM INDORE

Naseef Nazar is an MBA student in Indian Institute of Management Indore (IIMI).

He has cleared Chartered Financial Analyst (CFA) Level One in first attempt.

He is also certified in NISM Investment Advisor Level 1 with a score of 81.5% and NISM Research Analyst with a score of 92.5%.

He is passionate about banking and finance.

Well aware of the market trends, he is an active learner and dedicated student.

Team Sky BCS 05 Submission

Total Team Points: 39806.5

Team Air BCS 05 Submission

Total Team Points: 38397

Team Fire BCS 05 Submission

Total Team Points: 36238