Announcement

SEMI FINAL | BUSINESS CASE - BCS 05

Leader Submission BCS 05

NMO 2020

Financial Projections,Product Mix & Expansion Target of VELO E-Mobility

Submission Date & Time : 2020-04-10 10:04:02

Submitted By: Rahul Choudhury - Leader From Team Sky

Assignment Taken

Detailed overview of the Financial target, Product Mix & Expansion Plan for Next 5 YearsCase Understanding

Renewable energy has great potential in the automobile industry of India whereas the penetration of Electric Vehicles(EVs) in India is still low.Currently,the registered vehicles in the automobiles sector is 230 million and the market is a fast growing market. The Government target of achieving 30% on road EVs is based mainly on the aim to introduced electrification of 2-wheeler,3 wheeler and commercial vehicles.Fleet of passenger vehicles are placed at a lesser priority zone compared to these and they come a step behind. Now,as a team of budding entrepreneurs this is a golden opportunity to join the EV bandwagon and reap profits in the upcoming years as this is indeed the “future of Auto industry†going ahead. With a maximum possible fund of 1.6 cr (40 lac corpus fund+60 lac loan),the team needs to reach break even in minimum possible time and start generating profits. The team comprises a major chunk of Engineers(2 Mechanical,1 Electrical,1 Computer Science Grad),remaining 50% members are 2 fresh management graduates and 2 graduates with prior work experience in Marketing domain.BCS Solution Summary

For launching the E-Vehicles in the market successfully, from the primary and secondary research reports, it is recommended to launch the different E-Vehicles phase wise. As per planning, • Year 1 involves rolling out 2 Wheeler vehicles and 3 Wheeler vehicles • Investing into 4 wheelers can be checked for a while since right now adequate infrastructure in the form of charging stations are not available.Currently, Tata Group have made huge investments to build infrastructure as in electric car charging stations which is expected to be up and running within the next 3-5 years and build a good infrastructure in metro cities like Mumbai,Hyderabad,Delhi etc • Fully EVs are yet not suitable for Indian markets due to high population and trafficSolution

Solution

Venturing into EV Markets

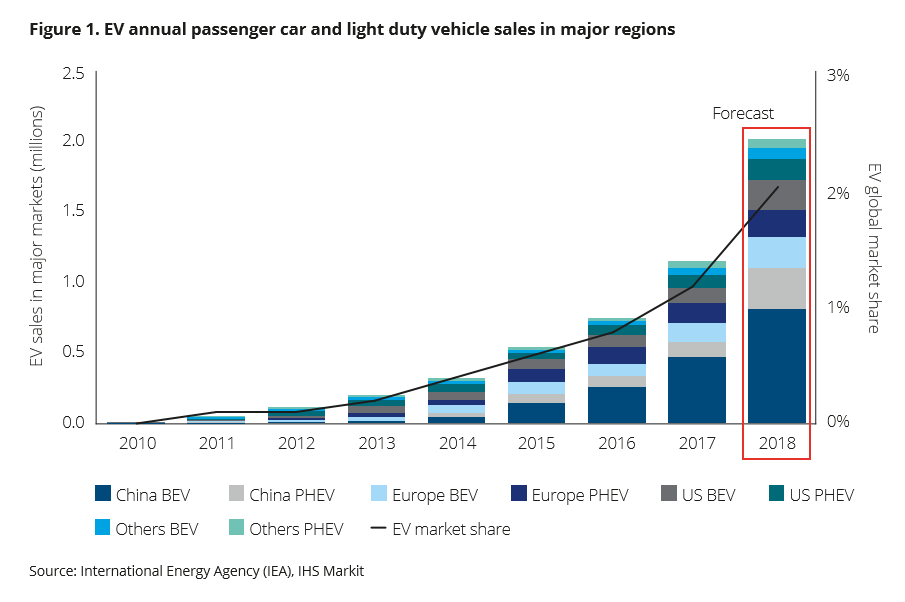

- Post 2015,EV sales has been doubled and Battery Electric Vehicles(BEVs) accounted for more than 66% of the global EV sales

- BEV & PHEVs combined accounted for a sale of one million units in 2017

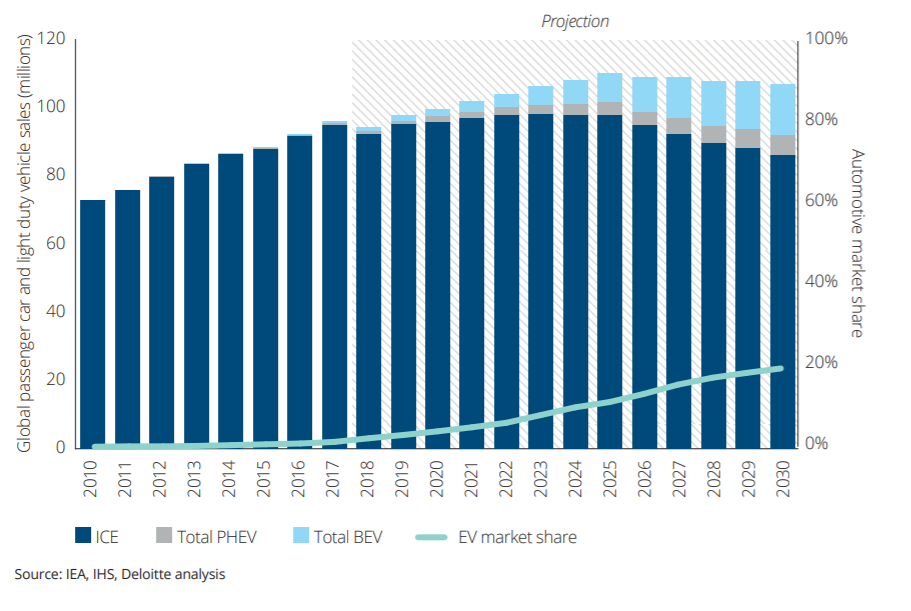

- By 2022,the sales are expected to reach a tipping point when the total cost of ownership becomes at par with the internal combustion engines

Key Triggers

- Dismal State of Auto Sector of India: Indian auto sector is still in its infancy & the market share of EVs in India is quite low compared to other countries

- Number of registered vehicles: Current number of registered vehicles in India is 230 m & it is constantly growing at a steady rate

- Less knowledge of renewable resources: Overdependence on fossil fuels currently

- Realistic target: Government target of reaching a 30% adoption of electric vehicles by 2030 with an enhanced focus on BEV,PHEV & electric scooters & bicycles

- Active participation in reducing carbon footprints: Reduction of carbon footprints and lesser pollution

- Global competitors: North America have already seen remarkable progress in the EV sector owing to the huge investments of motor giants Tesla & Ford

Product Mix

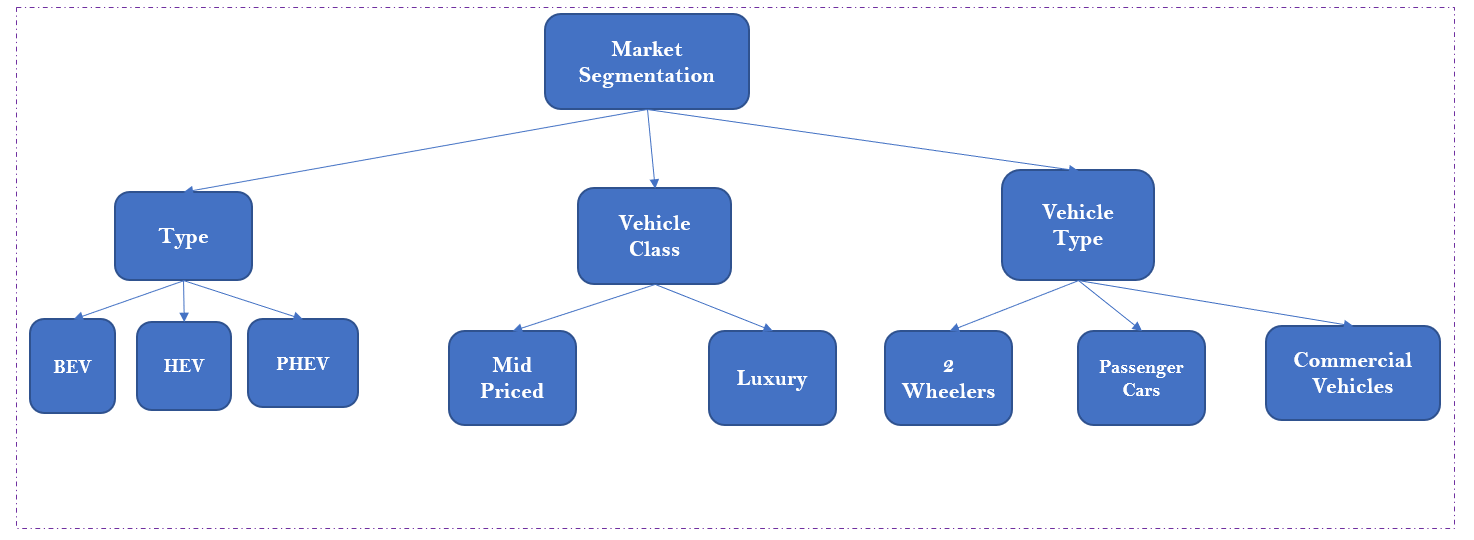

While working on the product mix, first let us break the EVs up into separate segments on the basis of the following parameters:

1.Type

On the basis of type,EVs can be further subdivided into

- Battery Electric Vehicles(BEV)

- Plug-in Hybrid Electric Vehicles(PHEV)

- Hybrid EVs(HEVs)

2.Vehicle Class

On the basis of class,EVs can be further subdivided into

- Mid Priced

- Luxury

3.Vehicle Type

On the basis of Vehicle, EVs can be further subdivided into one & off Road EVs like

- Electric bicycles

- Electric scooters

- Electric motorcycles

For an initial planning, the proposed product mix will be majorly comprising of two wheelers and three wheelers as of now which are given below:

Two Wheelers

- Eco SKUTI Lite(lower range scooter)

- Scoocity R100 (mid range scooter)

- Galaxity R150 (mid range bike)

- Bolt S160 (sportsbike)

Three Wheelers

- Erick R250(E-rickshaw)

- BlueBull 1T(loader mini Tempo)

- Knect R200 (E-Cart)

The detailed product mix can be somewhat like tabulated below ,assuming the expansion of product lines over a period of 5 years.

|

Proposed Product Mix (5 Year Plan) |

||||||

|

FY |

2 Wheelers |

3 Wheelers |

Commercial Vehicles |

Passenger Vehicles |

Hybrid EV |

Total |

|

2020 |

140 |

60 |

0 |

0 |

0 |

200 |

|

2021 |

280 |

120 |

0 |

0 |

20 |

420 |

|

2022 |

400 |

180 |

40 |

20 |

40 |

680 |

|

2023 |

460 |

207 |

46 |

23 |

46 |

782 |

|

2024 |

575 |

259 |

58 |

29 |

58 |

978 |

|

2025 |

748 |

336 |

75 |

37 |

75 |

1271 |

N.B. The key assumptions in this case are a 50% increase in capacity for the 2nd Year and a subsequent rise of 15%,25% and 30% percent as newer models and variants gets added to the product line.

Another Plan B can be if we go on for a mix of factory expansion and contract manufacturing.

Key assumptions in this are:

- The number of factories over the years increase from 1 in 2020 to 8 by 2025

- Subsequent rise of 15%,30% and 30% percent respectively YoY as newer models and variants gets added to the product line.

|

Plan B (Factory expansion+ Contract Manufacturing) |

||||||

|

Proposed Product Mix(5 Year Plan) |

||||||

|

FY |

2 Wheelers |

3 Wheelers |

Commerical Vehicles |

Passenger Vehicles |

Hybrid EV |

Total |

|

2020 |

140 |

60 |

0 |

0 |

0 |

200 |

|

2021 |

280 |

140 |

0 |

0 |

40 |

460 |

|

2022 |

600 |

720 |

160 |

80 |

160 |

1720 |

|

2023 |

720 |

864 |

192 |

96 |

192 |

2064 |

|

2024 |

936 |

1123 |

250 |

125 |

250 |

2683 |

|

2025 |

1217 |

1460 |

324 |

162 |

324 |

3488 |

Financial targets

- The financial targets for the 5-6 year period is keeping in mind that the sales varies roughly in between 70-80% of the self manufactured and those done by contract manufacturing combined

- Also, the commercial and passenger vehicles fleet are not in production until the second year since adequate infrastructure is not yet available in India

- The prices are kept competitive keeping in mind the similar ranged products of giant auto maunfacturers viz Tata Motors,Hyundai etc.

Revenues in '000s

FY

2020

2021

2022

2023

2024

2025

2 Wheelers

4690

7504

11596

13335.4

16669.25

21670.03

3 Wheelers

3900

6240

9360

10764

13455

17491.5

Commercial Vehicles

0

0

16000

18400

23000

29900

Passenger Vehicles

0

0

14400

16560

20700

26910

Hybrid EV

0

3200

19200

22080

27600

35880

Total

7302

16944

70556

81139.4

101424.3

131851.5

Expansion Plan for the next 5 years

The expansion plan can be phased out over the time period of the upcoming 5 years. Initially, adequate number of charging stations are not available to launch commercial or passenger fleet.

- For Year 1,the target is to launch the two wheeler and three wheeler vehicles across three major metro cities viz. Mumbai, Bangalore and Delhi.

- Initially, as a bootstrapped firm, we can approach for Series A,B or C type funding. Going by the initial 2 years turnover, Series A funding seems to be most feasible. We can raise capital from Venture Capital Firms like Sequoia Capital, Softbank etc-thereby improving our capital base to venture into newer markets with expanded product line.

- Post receiving the Series A funding, starting to invest more on factories and increasing our reach to other metro cities viz. Hyderabad, Kolkata and Pune.

- Inking a pact with commercial fleet provider, Lithium Urban Technologies once the firm starts producing commercial vehicles to address mobility solutions across passenger and freight segment

- Partnering with tech giants viz Wipro & Accenture for Value Added Services including fleet management and collaborating with Tata Power to install electric charging stations in their campuses.

- Post 2022,VELO is expected to supply commercial vehicles for the e-mobility carriers like Ola,Uber,Merucabs etc.

- As the organization reaches close to the 5 year mark,further capital infusion via Series B funding from investors like Warburg Pincus(if at all possible) will boost further expansion plans greatly.

Conclusion

The current market isn’t feasible to launch 4 wheelers in the Indian market, so the best option is to start with 2 wheelers and 3 wheelers. In the first two years,the launch follows a conservative approach- launching 2 wheelers and 3 wheelers in Year 1 followed up by launch of Hybrid EVs in Year 2. With Tatas and other big houses coming forward in setting up electric charging stations, the remaining product line can be expanded in the following years. By 2025,the firm expects an overall growth of approximately 1700% in terms of revenue. The company is expecting to break even by the end of 4th Year. The major breakthrough, however, depends on 2022(Year 3) when we are expected to launch both commercial and passenger fleet. This is also the deadline when the Government have decided to make 30% of the total on road EV fleets ,with special priority on maximising the target of electrification of two wheeler and three wheeler vehicles.Attached File Details

Comments

Dr Saroj Kumar Dutta

Financial Analysis projection is near to realities , product mix is full of creativity, and attractive. Brand name Chosen is also good. Expansion write up could be in more details, However overall submission is precise and to-the-point .

Karn Kumar

Amazing use of secondary research. Very Consultative approach. It is very much like an actual Market Research Report.

Rahul Choudhury

Indian Institute of Management Kashipur

Indian Institute of Management Kashipur

Thanks Saroj Sir and Karn Sir for the reviews.We would try to carry this forward and work for the possible improvements in the upcoming days as well.

Participant

Rahul Choudhury

Indian Institute of Management Kashipur

Curious,diligent,adaptable,empathetic and teamplayer.Being a student at MBA at Indian Institute of Management,Kashipur as part of the 2019-2021 batch.Being a keenly motivated individual, my chief interest lies in Business development,strategizing & helping businesses grow.Looking forward to be a part of the everchanging industry dynamics & give back to the society.Besides this, I have also been recognized as one of the Top 10 College Champions Competitive Business Leaders,India \\\\\\\'20 by Dare2Compete, in association with CRISIL & CNBC-TV18.

Team Sky BCS 05 Submission

Total Team Points: 39806.5

Team Air BCS 05 Submission

Total Team Points: 38397

Team Fire BCS 05 Submission

Total Team Points: 36238